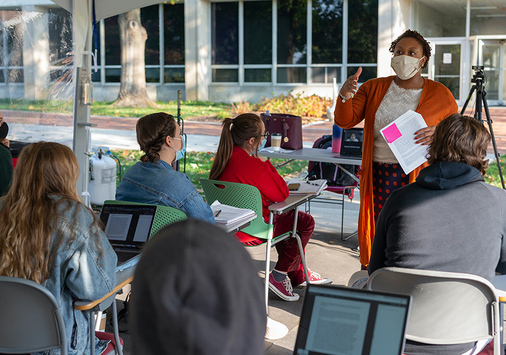

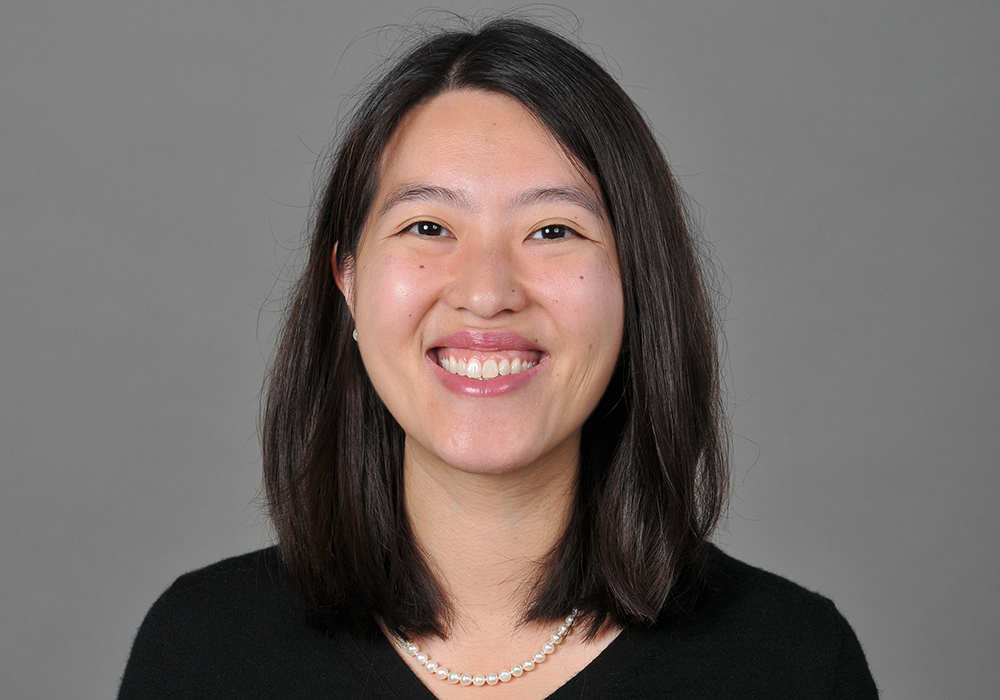

On Wednesday, April 1, Prof. Jessica Burch hosted our first Remote Whit’s Wednesday with guest Patricia Xi of the Psychology Department. As our global commerce majors were starting to grapple with the complex impacts of the COVID-19 pandemic, financial exploitation was the perfect place to start—an issue that is not at the top of the headlines but that can impact anyone, regardless of their current state of health.

The discussion kicked off with a video clip of John Oliver’s take on multi-level marketing businesses. This led into a conversation about the wide variety of types of scams that people may encounter—all of which come down to a process of financial exploitation based on an abuse of trust.

Participants were able to identify a broad range of phrases that describe scams, such as: bait & switch, not transparent, false advertising, too good to be true, and targeting vulnerability. They considered scam strategies such as advance fees, impersonation, mass marketing sweepstakes, and elder scams.

Once the group had identified this range of possibilities, Xi led the group in a discussion exploring the line between coercion and persuasion, and legitimate vs. illegitimate methods. The conversation ranged from Girl Scout cookies to Rodan & Fields and more. Where does the balance tip? When does something shift from being a persuasive marketing tactic to being coercion that takes advantage of a targeted client?

Throughout the discussion, Xi reinforced the reality that scams target vulnerability, which led the discussion to the question: how do race, socioeconomic status, access to education, and other factors contribute to vulnerability?

In her own research on sweepstakes scams, Xi has found no “perfect” equation for who will fall victim to this kind of financial exploitation. Everyone is potentially vulnerable, but an important factor what impacts is how an individual sees the “scam.” Do they see it as an opportunity that is worth the potential risk? Xi’s research on fake lottery scams found that 20-40% of participants agreed that they would send in a personal check to collect winnings—a number that may be surprising but helps to explain the effectiveness of such scams.

Building on this discussion of Xi’s work, one student offered that he sees the current global health crisis as a breeding ground for financial exploitation/scams aimed at college students who are being targeted for remote-work opportunities which are actually scams.

Another student agreed and showed the group a mailing she had recently received which offered to pay her $30/month for the next 3 years if she completed a survey (including sensitive personal information). She shared that she was initially planning to complete the survey since she had lost her regular student worker income. She was very thankful for this timely discussion!

This personal example brought home to the group the significance Xi’s research and the need to get the word out to college students about the threat of financial exploitation, especially in a time of crisis such as our current global pandemic.

Thank you to Patricia Xi for taking the time to share her knowledge and insights with us, to Jessica Burch for hosting the discussion, and to Mariana Saavedra Espinosa for planning the event. Students, faculty, and staff all appreciated this opportunity to explore important and timely issues and look forward to more opportunities to connect!